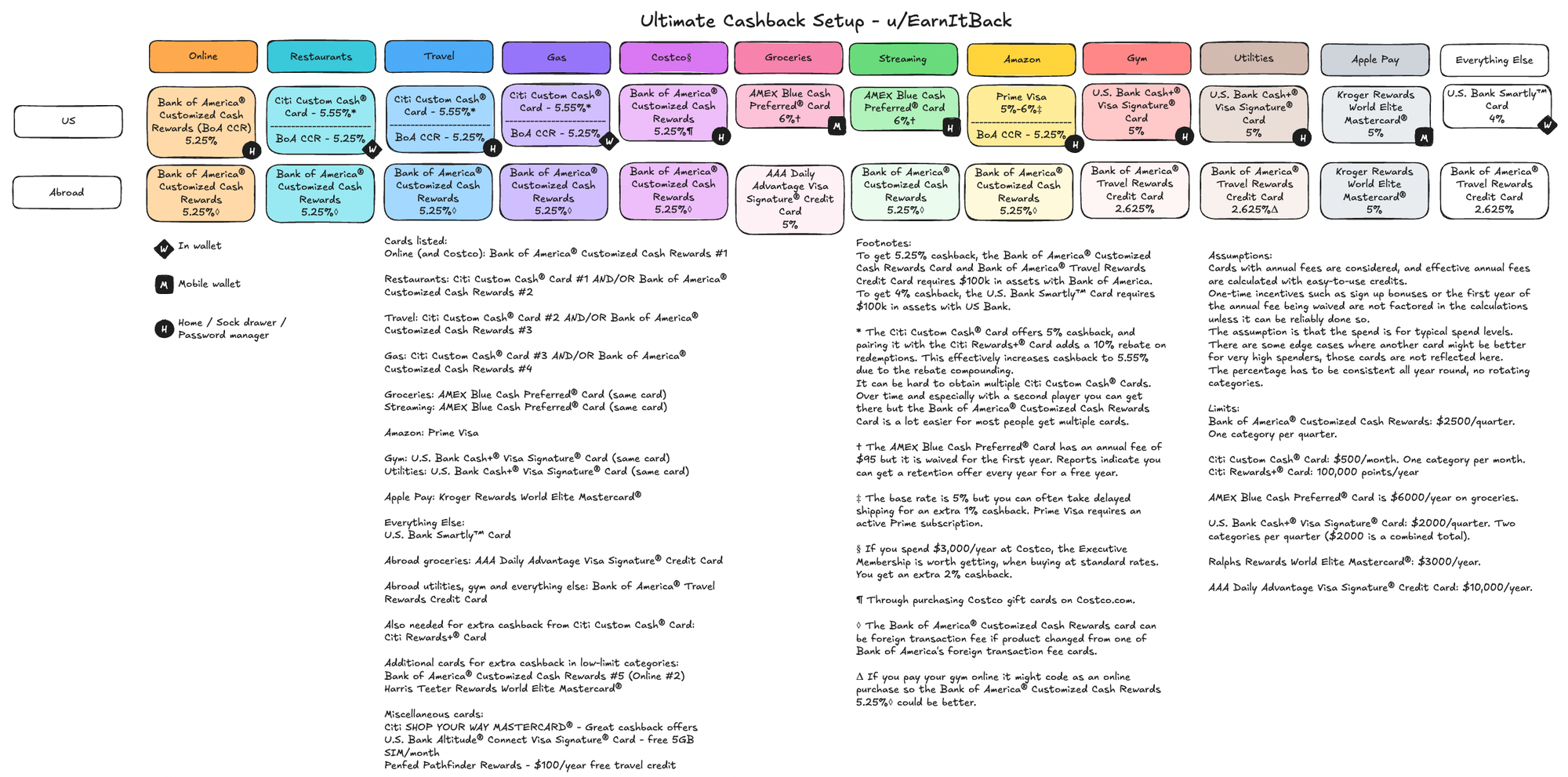

Many people try to optimize their cashback strategy, but this is the most optimized strategy I can create and the end game for cashback credit cards.

All category spends earns 5%+ and the Smartly Card puts the floor at 4% cashback on any US purchase.

It will take a long time to get all of these cards if starting from scratch (having a player 2 (such as a spouse who can also apply) will help increase the speed considerably).

[https://earnitback.com/uploads/2025/8072ab0f86.jpg](https://earnitback.com/uploads/2025/8072ab0f86.jpg) Most people shy away from complicated setups because of the cards you need to use. But I think you could just have 3 cards in your wallet, 2 in your mobile wallet, and the rest at home, with most untouched once you input them into the relevant website for the first time. Some categories (such as Citi Custom Cash cards) might have low limits for some people's spending habits, but you can get more cards in that category or similar cards to increase spending limits.

You need 10 cards in total to cover all of the US cards, and 12 for the complete end-game setup (16 if you need to get the BoA CCRs for foreign transactions).

I'll update the chart with any changes to the cashback landscape and any good tricks I see to increase cashback in these categories and write blogs about some of the ways to get all of these cards, the order to do it in, and other relevant tricks that might interest you if you're reading about cashback optimization.

Key

W - Wallet

M - Mobile Wallet (Apple Pay/Google Pay)

H - Home / in your sock drawer / keep the details in a password manager

Footnotes

To get 5.25% cashback, the Bank of America® Customized Cash Rewards Card and Bank of America® Travel Rewards Credit Card requires $100k in assets with Bank of America.

To get 4% cashback, the U.S. Bank Smartly™ Card requires $100k in assets with US Bank.

*The Citi Custom Cash® Card offers 5% cashback, and pairing it with the Citi Rewards+® Card adds a 10% rebate on redemptions. This effectively increases cashback to 5.55% due to the rebate compounding.

It can be hard to obtain multiple Citi Custom Cash® Cards. Over time and especially with a second player you can get there but the Bank of America® Customized Cash Rewards Card is a lot easier for most people get multiple cards.

† The AMEX Blue Cash Preferred® Card has an annual fee of $95 but it is waived for the first year. Reports indicate you can get a retention offer every year for a free year.

‡ The base rate is 5% but you can often take delayed shipping for an extra 1% cashback. Prime Visa requires an active Prime subscription.

§ If you spend $3,000/year at Costco, the Executive Membership is worth getting, when buying at standard rates. You get an extra 2% cashback.

¶ Through purchasing Costco gift cards on Costco.com.

◊ The Bank of America® Customized Cash Rewards card can be foreign transaction fee if product changed from one of Bank of America's foreign transaction fee cards.

Δ If you pay your gym online it might code as an online purchase so the Bank of America® Customized Cash Rewards

5.25%◊ could be better.

Assumptions

Cards with annual fees are considered, and effective annual fees are calculated with easy-to-use credits.

One-time incentives such as sign up bonuses or the first year of the annual fee being waived are not factored in the calculations unless it can be reliably done so.

The assumption is that the spend is for typical spend levels. There are some edge cases where another card might be better for very high spenders, those cards are not reflected here.

The percentage has to be consistent all year round, no rotating categories.

Limits

Bank of America® Customized Cash Rewards: $2500/quarter. One category per quarter.

Citi Custom Cash® Card: $500/month. One category per month.

Citi Rewards+® Card: 100,000 points/year

AMEX Blue Cash Preferred® Card is $6000/year on groceries.

U.S. Bank Cash+® Visa Signature® Card: $2000/quarter. Two categories per quarter ($2000 is a combined total).

Ralphs Rewards World Elite Mastercard®: $3000/year.

AAA Daily Advantage Visa Signature® Credit Card: $10,000/year.

Cards Needed

Cards listed:

Online (and Costco): Bank of America® Customized Cash Rewards #1

Restaurants: Citi Custom Cash® Card #1 AND/OR Bank of America® Customized Cash Rewards #2

Travel: Citi Custom Cash® Card #2 AND/OR Bank of America® Customized Cash Rewards #3

Gas: Citi Custom Cash® Card #3 AND/OR Bank of America® Customized Cash Rewards #4

Groceries: AMEX Blue Cash Preferred® Card (same card)

Streaming: AMEX Blue Cash Preferred® Card (same card)

Amazon: Prime Visa

Gym: U.S. Bank Cash+® Visa Signature® Card (same card)

Utilities: U.S. Bank Cash+® Visa Signature® Card (same card)

Apple Pay: Kroger Rewards World Elite Mastercard®

Everything Else:

U.S. Bank Smartly™ Card

Abroad groceries: AAA Daily Advantage Visa Signature® Credit Card

Abroad utilities, gym and everything else: Bank of America® Travel Rewards Credit Card

Also needed for extra cashback from Citi Custom Cash® Card:

Citi Rewards+® Card

Additional cards for extra cashback in low-limit categories:

Bank of America® Customized Cash Rewards #5 (Online #2)

Harris Teeter Rewards World Elite Mastercard®

Miscellaneous cards:

Citi SHOP YOUR WAY MASTERCARD® - Great cashback offers

U.S. Bank Altitude® Connect Visa Signature® Card - free 5GB SIM/month

Penfed Pathfinder Rewards - $100/year free travel credit